Monaco’s property market is the most expensive in the world, with demand for real estate of all types remaining high.

The exclusivity of Monaco is unparalleled. One of the smallest states on earth, only Vatican City is smaller by area, Monaco is home to more millionaires as a proportion of population than any other country, according to a report from WealthInsight.

Celebrities, titans of industry, aristocrats, and other global elites call the Principality home. Monaco’s appeal is far-reaching. Fine dining, luxury shopping, a sporting calendar which seems tailor-made for the global elite, an attractive fiscal regime for residents, its location on the Mediterranean, and history, all contribute to its international standing.

These factors mean that demand for real estate of all types is high, despite the recent Covid-19 pandemic. The residential property market remains the most expensive in the world and supply of new property is scarce. There are a number of new developments in the pipeline, such as the ambitious land reclamation project, Portier Cove, although these schemes are only expected to make a dent in the supply shortage.

Monaco remains the most expensive location for residential property with an average price per square metre of over €48,000. Within Monaco itself, the district of Monte Carlo is more expensive still with an average price of €53,000 per square metre.

Only values in Hong Kong come close to competing for the title of most expensive real estate. Monaco and Hong Kong are both severely constrained by available space and bolstered by their global reputations. Prime property in New York costs half as much as Monaco, while London and Paris cost 60% and 68% less respectively.

The market in 2019

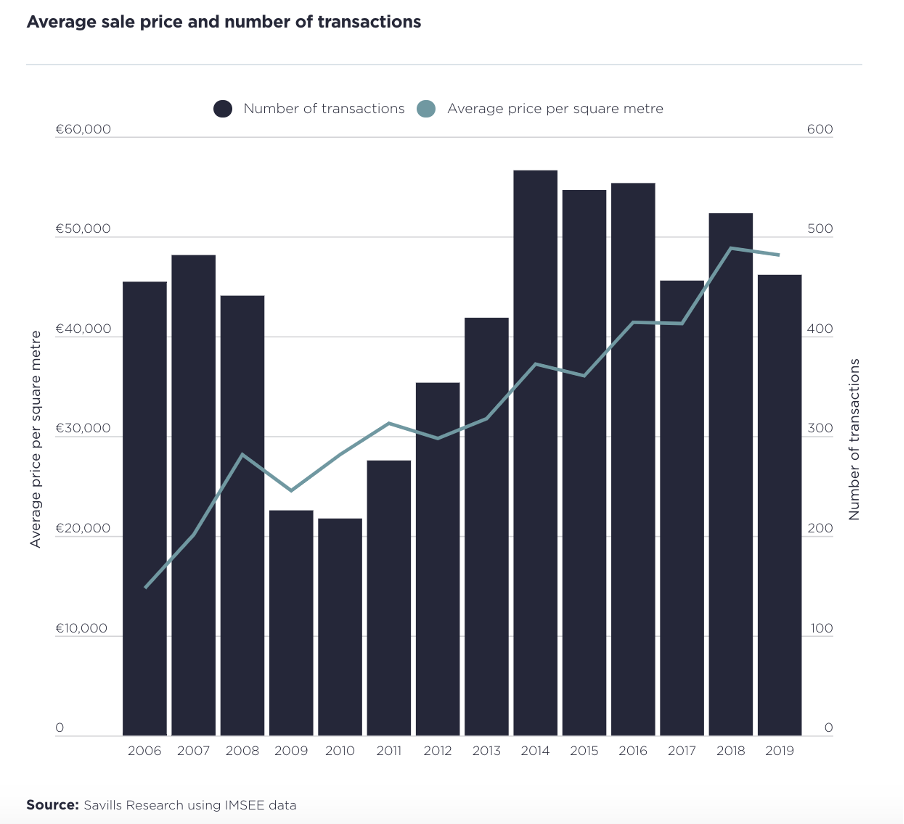

The average sale price in Monaco in 2019 was €48,151 per square metre, 1.3% below the value recorded in 2018. This small fall follows prices seeing an exceptional rise of 18.1% the previous year as prices reached a high plateau.

Transaction volumes fell by 12% in 2019 versus 2018, driven by an 18% decline in sales of properties priced under €5m. This decline was caused by a drop in the number of one- and two-bedroom properties available for sale in comparison to 2018.

OUTLOOK

Resilience

Monaco punches well above its weight on the world stage with a profile in line with top-tier global cities. The diverse demand base means the Principality will remain a sought-after destination. Additionally, Monaco has proved to be relatively immune to political and economic instability, especially in light of Covid-19, and this resilience is forecast to continue to attract buyers and renters.

Development activity and prices

The global reputation of Monaco ensures that demand levels across the Principality outstrip supply in this space-constrained location. Going forward, though there are new developments in the pipeline, the promised new units are fewer than needed. These dynamics mean that prices, although the highest in the world, are expected to remain stable.

Amenities over views

As more towers are built across Monaco, properties which once had a sea view might be obstructed in the future. To counteract this, developers are prioritising amenities like pools, gyms, cinemas, spas, and parking garages.

Rental values

The outlook for the rental market is likely to be dependent on property size, as seen in 2019. As the Monegasque government examines residency applications more closely, it could become more difficult for couples and individuals to obtain residency through renting a smaller property, causing potential rental decreases for those sizes. However, we expect demand and rental values for larger properties to continue to increase.

Article by Irene Luke, Partner at Savills Monaco